How To Become A CFO – 6 Proven Steps For Success!

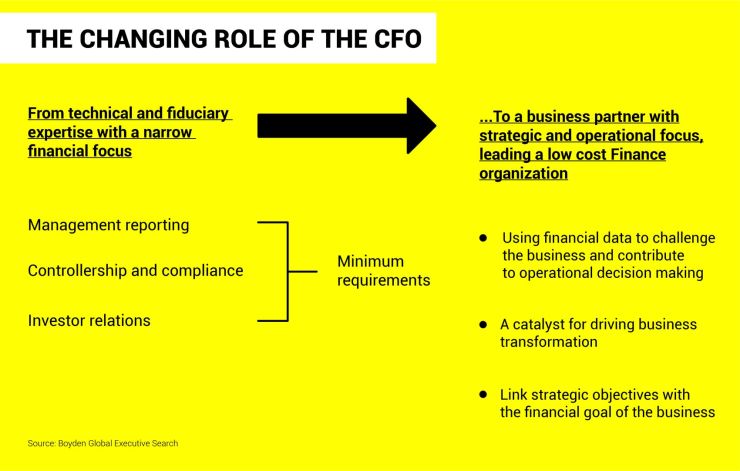

Being a CFO has transformed over recent years. Today it’s more challenging, strategic and embraces cutting-edge technologies.

Let's discuss the ways to get to the top, and specifically, how to become a CFO.

The appointment to Chief Financial Officer (CFO) is an impressive one in the business world – it’s a career that will always be in high demand. This is especially true if you have operational experience, have taken a company through an IPO, or managed a successful exit. The COO role is becoming obsolete as companies try to create efficiencies by handing off much of the COO duties to CFOs, a Korn Ferry placement leader said during CFO Live. That gives CFOs the chance to become more operationally experienced, increasing the influence and importance of the role.

But getting there takes more than just luck and a great deal of commitment. This blog explores the skills, experience, and degrees needed to progress your finance career and become a CFO. This blog aims to help you take the first steps on how to become a Chief Financial Officer, which includes exploring the skills, experience, and degrees needed to progress your finance career and become a CFO.

What is a CFO?

A Chief Financial Officer is an executive who handles the financial actions of a company. Traditionally, a CFO would oversee the finance and accounting divisions of the business to ensure accurate and timely financial reports, successful cash flow, and regulatory compliance, providing a “tick box” response to management decisions.

The role today is much more proactive. A CFO drives the direction and success of an organization by using financial data to guide operational strategy.

What does a CFO do?

The Chief Financial Officer is part of the top tier of executives, joining the Chief Executive Officer (CEO) and the Chief Operating Officer (COO), although depending on the company there are often other C-executives.

The CFO manages a team of accountants, controllers, analysts, tax professionals, human resources, and specialists that are responsible for investments. The branches of the hierarchy may differ from one company to another, but the CFO always manages the entire financial department.

CFOs are directly involved in strategies that aim to reduce the costs and expenses of the business while optimizing profits. They also oversee the budgeting of the company and the fiscal reporting.

The Chief Financial Officer plans the financial future of the business by analyzing and empowering the financial present, working with stakeholders and other members of the C-suite to establish business goals, and identifying the steps needed to reach them.

CFO vs CEO

CEO, CFO, and other chief positions, such as CMO (Chief Marketing Officer) and COO (Chief Operating Officer), play vital roles in the success (and failure) of a company. Even though they share a common goal—i.e., to collaborate and achieve all company objectives—CEOs and CFOs play vastly different roles.

In the previous section, a CFO was described as the figure who is responsible for the financial department as a whole. If there’s anything worth reporting, the CFO takes it up with the CEO.

A CEO, on the other hand, plays a broader role—overseeing the operations of the company as a whole. The CEO reports to the board of directors and nobody else.

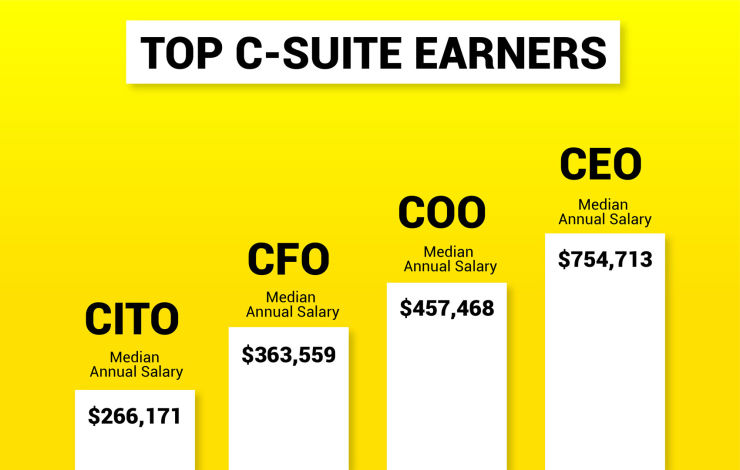

So, the CEO vs. CFO confusion can be ironed out in one short answer: the CEO is higher in the organizational structure than the CFO. But to add more to the confusion, in terms of CFO vs. CEO salary ranges, the CFO may receive a higher salary than the CEO.

CFO to CEO: is it possible?

It’s entirely possible for a CFO to be promoted to a CEO. However, there is a whole debate on whether a CFO is psychologically equipped to take on the responsibilities of a CEO. Due to the slight gap in salary, money should not be the driving force behind someone’s decision to go from CFO-CEO.

With that said, there is a growing trend in India where CFOs have been promoted to the CEO position. Because risk management is a substantial part of a CFO’s duties, they have a competitive edge over CMOs and other C-level employees to take on the mantle of a CEO.

CFO salaries and job prospects

Salaries in this field are very attractive. According to Salary.com, the average yearly income of a Chief Financial Officer in the US is $395,004, ranging from $300,676 to $502,063. A CFO may also receive bonuses, commissions, and profit-sharing plans.

Salaries are affected by the person’s education, additional skills, certifications, and years of experience in the role. A comparative ‘Pay by Experience’ data by Payscale suggests that a CFO who has 20+ years of experience can gain up to 63% more than a beginner in the industry.

Other factors like company size and the type of industry your business works in may also affect the salary you are offered. Salaries and other bonuses for this position differ regionally and are often higher in metropolitan areas and developed countries.

As for job opportunities, BLS projected 4% overall employment growth of top executives, including CFOs, from 2019 to 2029. The predicted growth varies by industry, with companies operating in the healthcare and educational support sectors expected to grow by 10% to 16% over the same ten-year period.

Currently, there are about 218,300 available vacancies for CFOs every year. These job openings are due to general movement in the employment market and because the baby boomer generation is now facing retirement.

Despite these numbers, applicants for CFO and other C-suite roles face a competitive market, mainly because of their high salary and prestige. This does not mean that CFO vacancies have slowed down. Since the pandemic and the massive changes affecting companies around the world, more business owners and management teams need timely and accurate data to identify trends, forecast productivity, and facilitate strategic decisions for growth.

How do you become a CFO of a company?

The career path to CFO is not as easy as taking a few courses and polishing your CV. Some steps to achieving the career goal of CFO are detailed below.

1. Obtain relevant degrees and qualifications

A CFO position usually requires a bachelor’s degree and a master’s degree relevant to finance and business administration.

For those interested in learning more about pursuing a degree in order to gain the skills and experience to become a CFO, view our range of Online BBA and MBA programs, with available specialization areas.

There are also several professional qualifications that can help your chances of career progression.

2. Gain experience in the financial industry

Getting experience in the financial field is essential for a future CFO. You can pursue any financial job that involves planning and a certain level of management to get more skills. Internships and work experience will also be useful.

3. Try out different roles within the company

If you plan to grow professionally in the same company, be prepared to go through various roles and work your way to the top.

That means you might need to accept jobs that are not so tightly linked to finance. These roles might include customer service, human resources, or operational expertise. Each position will develop your skills and give you a thorough understanding of the inner workings of the company’s operations.

4. Become conversant with the latest technology

Today’s CFOs need to be on top of digital technology too. You will need to embrace ERP (Enterprise Resource Planning) software, analytics, cloud-based systems, automated reporting, and an integrated route to clearly understand the forecasts and what they mean for your company. The ability to handle big data and employ the insights it gives you in data-driven decision-making is key to taking on the financial world in the coming decade.

5. Create useful connections

Career networking is always useful as you build your profile and experience. You never know where a conversation may lead. People that you develop professional relationships with may lead to a great job opportunity that you might not have been aware of.

6. Understand what you will be expected to do in the C-suite

Being part of the C-suite of a company means having executive power and exercising it. Aside from your technical skills, your leadership skills are essential in this role. Develop your soft skills of problem-resolution, clear communication, and teamwork to thrive in this position. With the pace of change in the world of business, demonstrating your ability to continue learning and upskilling is a positive trait.

Having a deeper understanding of what the board, company, and fellow leaders expect from a CFO will equip you to fit comfortably into the role.

FAQs

Below are some of the most frequently asked questions regarding becoming a CFO:

How hard is it to be a CFO?

Being a CFO is no easy task. It requires a great deal of knowledge and experience in the financial field, as well as an understanding of business operations and strategy. CFOs are responsible for managing the financial health of their organization, which includes overseeing budgeting, forecasting, financial planning & reporting, and compliance with laws and regulations. They must also be able to effectively communicate with stakeholders such as shareholders, board members, and other senior executives.

Additionally, they must be able to make sound decisions that will benefit the company in the long run while also staying within budget constraints. Being a CFO is not only challenging but also rewarding; it requires a great deal of dedication and hard work but can lead to great success for both the individual and their organization.

How long does it take to become a CFO?

Becoming a Chief Financial Officer (CFO) is a long and difficult process that requires dedication, hard work, and experience. Generally, it takes at least 10 years of experience in the field of finance to become a CFO. This includes working in various roles such as an accountant, financial analyst, controller, treasurer or other related positions.

It is important to have a strong understanding of accounting principles and financial analysis techniques as well as excellent communication skills. Additionally, having an MBA or other advanced degree can be beneficial for those looking to become a CFO. Finally, having the right connections and networking within the industry can help you get your foot in the door and increase your chances of becoming a CFO.

What qualifications are needed to become a CFO?

There is no such thing as a CFO degree or CFO certificate, so there is no instant path you can take to become the financial leader of a company. That said, education is a significant part of your path to becoming a top finance professional and meeting the minimum Chief Financial Officer qualifications. The following sections will describe how to become a CFO through years of studying.

Bachelor’s degree

The most common bachelor’s degrees to build a strong foundation in finance are accounting, finance, economics, business administration, and public administration. Earning a bachelor’s degree in business (or any field) is the first step toward meeting and possessing the minimum CFO qualifications and skills.

CPA

You may become a CPA or Certified Public Accountant as a stepping stone to becoming a CFO. But is it one of the mandatory CFO requirements? Not really! While some CFOs started as accountants, it’s not essential these days. However, it will help to have a solid foundation in financial accounting, business law, and taxation.

CMA

Should you get a CMA certification to become a CFO? That depends on several factors. Being a certified management consultant is not usually an essential qualification to becoming a CFO but obtaining a CMA degree can be helpful as those skills will help in your role as a CFO.

CFA

Can I become a CFO after CFA? Yes, you can. In terms of technical expertise, a chartered financial analyst has more strength in analysis and forecasting, with a heavy focus on portfolio management, compared to a CPA. But CPA certification has much more to offer in accounting expertise and skills relevant to CFO.

If you choose to pair your CFA certification with an MBA, you can take a program that can help you gain the technical skills you lack.

MBA

The postgraduate degree of MBA will prepare you to meet the CFO qualifications by boosting your business knowledge and polishing your leadership and management skills. It is not a strict requirement to the finance career path of becoming a CFO but it’s a popular stepping stone to landing the role. In fact, 54% of Fortune 100 CFOs hold an MBA degree. Obtaining an MBA will give you a competitive advantage, as the experience you gain will enhance your business decision-making, which is one of the essential CFO skills you must possess.

EMBA

Like an MBA, an Executive MBA focuses on teaching about leadership and strategy in a corporate setting. It is particularly designed for professionals who want to take a C-suite role. This degree can give your profile a big boost.

Your education is important in getting that dream job. So if you’re looking for programs and courses that can equip you to obtain the best career opportunities, choose modern universities that offer education tailored to your needs. Check Nexford University for programs backed up by research into what skills employers are looking for in the current and future job market.

What should I study to become a CFO?

To become a CFO, it is important to have a solid foundation in business and finance. A bachelor's degree in accounting, finance, or economics is a great starting point for those interested in becoming a CFO. It is also beneficial to pursue an MBA or other advanced degree in order to gain more specialized knowledge and skills.

Additionally, it is important to stay up-to-date on the latest trends in the field of finance and accounting. Taking courses related to financial management, budgeting, forecasting, and risk management can help prepare you for the role of CFO.

Finally, gaining experience through internships or working as an accountant or financial analyst can be extremely beneficial when applying for a CFO position.

Learn how to develop the most in-demand skills for your future career!

Discover how you can acquire the most in-demand skills with our free report, and open the doors to a successful career.

What skills are needed to become a CFO?

Besides academic or technical qualifications, C-suite positions require management skills. Almost everything you do as a CFO involves some form of leadership. Whether it’s managing a team to implement new financial infrastructure or getting other executives on board with a plan, understanding leadership fundamentals is crucial to success.

Leadership

Leadership is one of the most important skills an executive should have. That means you must be able to understand and encourage people, make decisions, take on challenges, and learn from past experiences. Some leadership skills can be developed through experience, but courses covering leadership styles are a great way to accelerate your management expertise.

Communication and presentation

To be a CFO, you will need clear communication and presentation skills to explain financial constructs that inform decisions the company makes. You should be able to take the deeply technical financial data you’re handling and present it to your colleagues and stakeholders in an accessible and meaningful way. An ability and refined skillset to do business internationally can be a great advantage.

Technical and technology

An executive candidate should possess technical literacy particular to their role and industry. They must be up-to-date on the laws, financial governance, and information technology that is part of their work. An ability to embrace new technology, such as Artificial Intelligence or Digital Transformation to enhance data interpretation and forecasting is key to becoming a great CFO.

Change management

There’s a demand for leaders who are skilled at change management. A change driver executive can identify opportunities for change and leading the organization in taking that path.

Strategic thinking

One of the main responsibilities of an executive is to create strategies that will lead the business to success. Strategic thinking also means factoring in the needs of every part of the company to prepare plans that will benefit the whole organization.

A clear understanding of the company and industry

To direct future operations with clear financial backing, a CFO also needs to thoroughly understand the business model of the company and have a grasp of all aspects of the industry as a whole: the trends, new regulations, innovations, and emerging new markets. A good finance professional will be able to also focus on risk management, both commercial and financial.

Decision making

A major part of the job of CFO is to make big decisions that affect the organization. It’s not enough to understand the financial position of the company and current trends – it’s also necessary to be able to make decisions based on that information.

Problem-solving

A problem-solver has the ability to identify the root cause of the problem and find an effective solution to address it. All CFOs will encounter problems as they manage their team, understand the finances, and engage with other executives.

Time management

A CFO needs to be good at managing their time. Being able to organize time in a smart and consistent way is a necessary skill for a leader. You should also know how to prioritize responsibilities and delegate tasks.

What qualities make a good CFO?

A good CFO should possess a variety of qualities. They must be able to think strategically, have strong financial acumen, and be able to communicate effectively with stakeholders. They should also have an understanding of the industry they are working in and the ability to identify potential risks and opportunities.

Additionally, they should be able to manage multiple projects at once and have excellent problem-solving skills. A good CFO will also have a strong work ethic and be willing to go the extra mile for their company.

Finally, they should be able to build relationships with other departments within the organization as well as external partners. All of these qualities combined make a great CFO who can help lead their organization towards success.

How can you progress your financial career?

To progress in your financial career, you will need to embrace ongoing learning and development, sharpening your technical, leadership, and managerial skills.

Grab every opportunity you can to learn and gain experience in the financial industry. You can take internships and get advanced degrees and certifications.

If you’re already working, immerse yourself in projects that can give you more insights into the business world. Don’t be afraid to ask for advice and learn from professionals with more experience than you. Look for learning opportunities that you can complete alongside your job to expand and refine your skillset.

Bottom line

Becoming a CFO isn’t easy – but it’s certainly worth the effort. To reach the very top, you’ll need to combine technical and soft skills. We’ve created a series of quizzes so you can identify the learning and development needed to reach your goals.

Test your finance skills and management skills to see where your skill gaps are, and find out if an MBA is right for you.

Mark is a college graduate with Honours in Copywriting. He is the Content Marketing Manager at Nexford, creating engaging, thought-provoking, and action-oriented content.

Join our newsletter and be the first to receive news about our programs, events and articles.